It’s been two years since my original deep dive on BATS (which you can still find here), so I thought it was a good time to check back in. Let’s see how the thesis has played out so far and where things stand today in terms of dividend safety and valuation.

I actually did a shorter update in Newsletter #41 if you want the digest version. Still, for this deep dive, I want to revisit my original investment case before walking through the numbers again.

Right now, I own 201 shares of British American Tobacco ($BTI). At the time I bought them, I was mostly invested in US stocks and just kept the shares in USD. That was really the only reason behind the currency choice as I get asked this a lot.

BTI makes up about 7.5% of my portfolio, with an average cost in the mid-thirties. Since then, the stock has done well, delivering both solid price appreciation and a steady stream of income.

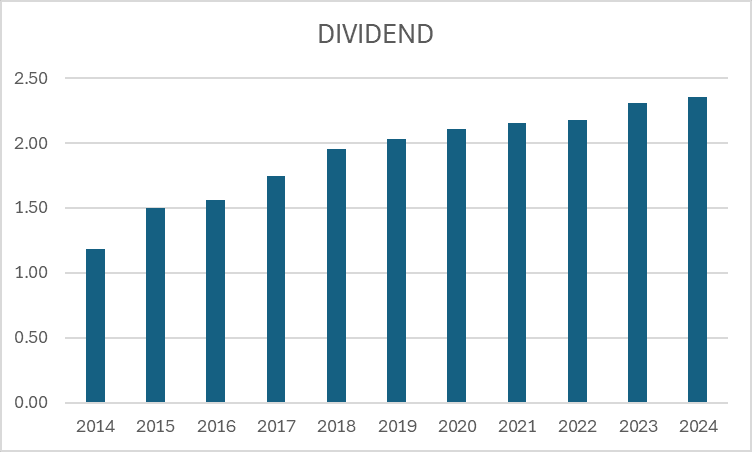

On the income side, my yield on cost is close to 9%. That means the dividends I collect every year are almost 10% of my original investment. Hitting that kind of YOC target has been great, and over time, the payouts have added up nicely. In fact, I’ve already received back more than one-fifth of my initial outlay in dividends alone. That said, payout growth has slowed down. BATS is behaving much more like a bond proxy than a long-term compounding machine.

On the price side, shares have gone from the mid-thirties to the mid-fifties, so I’ve also seen a healthy chunk of capital appreciation. The challenge for me now is the valuation, especially with the combustible segment shrinking as fast as it is.

This is where I remind myself of my goal, income, not price appreciation. For me, BATS is an “income factory” holding. I like seeing leverage come down, but I’d also like to see the top and bottom lines stabilise. Looking ahead, I’m only expecting dividend growth of maybe 2% or less.

I’ll continue holding because of my high YOC, but I do have clear sell triggers:

- If free cash flow starts to decline meaningfully, or management looks unlikely to meet their FCF targets through 2030

- If the dividend is cut

| Note: We call this an in-depth analysis because we extensively studied the information available to us. However, we do prefer to keep our writing digestible. That’s why not every detail we found is written down, but feel free to follow up if you have any further questions. |

Summary

- British American Tobacco has grown its dividend for 25 years. However, its growth rate has declined over the last three years in line with cash flow.

- New Products are performing well and are on track to meet management’s target.s

- Risks persist, and the question is whether they can grow New products quickly enough to offset the decline in combustibles.

About British American Tobacco (BAT.L)

We already went through most of the company’s history in the first deep dive back in 2023, so I won’t repeat myself here. BAT has been around since 1902, but the real turning point came in 2017 when it acquired Reynolds American.

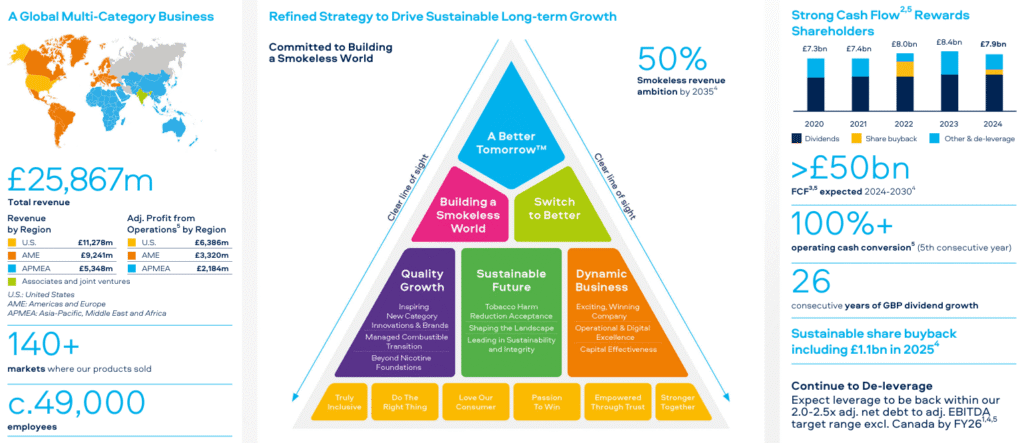

That deal secured BAT’s place in the U.S. market, which today is still its single biggest source of revenue, making up 44% of group sales in 2024. The flip side, of course, is that it also loaded the balance sheet with a mountain of debt, goodwill and intangibles, something that still hangs over the company today.

On the podcast, we often poke fun at BAT’s slogan, “A Better Tomorrow.” The irony is pretty obvious when you think about what the company actually sells. However, the idea behind it is to reduce the health impact by offering adult consumers alternatives like vapour, heated tobacco and nicotine pouches.

That said, in 2023, they changed the message with a new tagline: “Building a Smokeless World.” In plain English, this is the company admitting that the best choice for any smoker is to quit combustibles altogether.

I’ll be honest, I struggle with this. On one hand, it’s a step in the right direction, but on the other, it’s hard to take seriously when more than 80% of revenue still comes from cigarettes.

To me, it feels more like an admission that their core business is in structural decline, and I don’t think it’s a coincidence that the company also had to take a £31.5bn impairment on its U.S. cigarette brands around the same time.

It reminds me of what we’ve been saying about changing consumer behaviour in alcohol with companies like Diageo: people are drinking less and differently, and with tobacco, the shift towards alternatives is following the same pattern.

| British American Tobacco’s Mission BAT’s mission revolves around providing consumers with alternatives that are not only enjoyable but also less detrimental to health, all while minimising the environmental footprint of their operations. They are steadfast in their pursuit of sustainable growth and delivering robust returns to their shareholders. |

A Brief History of the Company

British American Tobacco has been around a long time, and like many companies with over a century of history, it has taken more than a few detours along the way.

At its core, BAT is, of course, a tobacco company, but over the years, it has diversified into various sectors, including retail and insurance. Some of those moves were smart, others… less so.

The story begins in 1902, when Imperial Tobacco in the UK and American Tobacco in the US joined forces to form the British American Tobacco Company. James “Buck” Duke, the first chairman, laid out a strategy built on scale, efficiency, and aggressive pricing, which worked.

Within just a few years, BAT had expanded into markets across the West Indies, India, Ceylon, Egypt, and much of Europe. By 1910, it was already selling over 10 billion cigarettes a year, and just two years later, it was listed on the London Stock Exchange. By the end of World War I in 1915, demand from soldiers had pushed annual sales up to 25 billion.

Fast forward to the 1960s, and BAT started to lose its sense of direction. Instead of sticking to tobacco, the company expanded into cosmetics, food, and even retail, acquiring Argos in the UK and Saks Fifth Avenue in the US.

At the same time, though, it strengthened its roots by acquiring Henri Wintermans cigars in 1966, which helped profits climb past £100 million for the first time (approximately £2.3 billion in today’s money). By 1976, BAT Industries had been established, and it had become the UK’s third-largest company, producing over 500 billion cigarettes annually, which equated to approximately 120 cigarettes for every person on the planet at the time. (As a non-smoker, that is crazy)

The diversification didn’t stop there. During the 1980s, BAT became a major player in insurance, snapping up Eagle Star, Allied Dunbar, and Farmers Group. By the late 1980s, it was the largest UK-based insurance group. But by 1998, that experiment was over, the financial services businesses were spun off, and BAT refocused on tobacco, listing as a standalone company in London once again.

The modern BAT we know today really started to take shape in the 1990s. The acquisition of American Tobacco in 1994 added brands like Lucky Strike and Pall Mall, and the merger with Rothmans in 1999 brought in Dunhill.

Expansion continued in the 2000s with assets in Turkey and Colombia, and later on with a major investment in Reynolds American in the US. In 2017, BAT bought the rest of Reynolds outright, cementing its dominance in the U.S. market but also saddling itself with a heavy load of debt and intangibles that still weigh on the balance sheet today.

More recently, BAT has been building its “new categories” strategy. Nicoventures was launched in 2011 to push into vapour and alternative nicotine products, and acquisitions like Fiedler & Lundgren expanded its footprint in snus.

By 2022, the company was even experimenting in biotech through KBio Holdings, a spin-off from its Kentucky BioProcessing arm, demonstrating its willingness to look beyond traditional cigarettes once again.

So while BAT’s history is littered with side quests into retail and insurance, the big picture today is clear: this is a company that has always been willing to adapt, even if not always gracefully.

Personally, that adaptability is part of the appeal, but so too is the recognition that the heart of the business, combustible tobacco, is in decline, and the next decade will depend on whether New Categories can fill the gap.

Business Model

In the last deep dive, we spoke about the decline in combustible sales and included some reports from www.cdc.gov with data up to 2020. This is further compounded by a publication by the WHO –WHO global report on trends in prevalence of tobacco use 2000–2030

Long story short, tobacco use is declining, but at this stage, that is no real secret. To combat this, BAT’s business model is now a multi-category portfolio designed to transition away from traditional combustible products.

The company’s revenue streams are categorised into two key segments: the legacy Combustible business and the high-growth New Categories portfolio.

They may not admit it right now, but the cornerstone of the business remains the traditional Combustible segment, which generated approximately 80% of total group revenue in 2024.

This segment is built on a portfolio of well-known brands, including Kent, Dunhill, Pall Mall, Lucky Strike, and Rothmans. As touched on previously, this business continues to be the primary engine of cash generation, providing the capital necessary to fund the company’s transition.

In parallel, the New Categories portfolio represents the company’s future growth. This segment is made up of three key product types:

- Vapour: The company’s flagship brand is Vuse. The portfolio has expanded with new products like Vuse Go, which quickly gained market share in key markets like the UK and France.

- Tobacco Heating Products (THP): The company’s offering in this space is centred on the Glo brand. These products are used to heat tobacco rather than burn it, providing a reduced-risk alternative.

- Modern Oral: This category, which includes tobacco-free nicotine pouches, is driven by the Velo brand. The product has a strong market position, mainly in the Swedish oral market.

Catalysts and Growth Opportunities

When it comes to scale, BAT is still a heavyweight. It ranks among the top five global tobacco companies and controls approximately 30% of the U.S. market. In most industries, a market share that size would be constantly under attack, but tobacco is different.

The sheer amount of regulation, combined with heavy advertising restrictions, actually makes it very hard for new competitors to break in. In practice, this “freezes” market share and locks in consumer loyalty, which is why BAT continues to earn such chunky margins from its core products.

That said, market share alone no longer moves the needle. We’ve seen this with companies like Intel; being big isn’t enough if you’re not innovating. For BAT, the challenge is even bigger because inflation has been biting in the U.S., and many smokers are trading down to cheaper brands. This pressure on the core combustible business means the real growth story has to come from somewhere else.

And that “somewhere else” is New Categories. Whether it’s vapour, heated tobacco, or modern oral products, this side of the business is where BAT has been putting its chips.

It’s already 17.5% of revenue and growing fast. If management can keep that momentum going and actually hit their 50 million smokeless consumers target by 2030, then the narrative shifts. BAT stops being just a shrinking cigarette business…

| Year | Total Group Revenue (£m) | Revenue from Combustibles (£m) | Revenue from New Categories (£m) | New Categories Revenue (% of Total) |

|---|---|---|---|---|

| 2024 | 25,900 | 20,700 | 3,400 | 13.13% |

| 2023 | 25,600 | 22,100 | 3,312 | 12.94% |

| 2022 | 27,655 | 23,030 | 2,894 | 10.46% |

| 2021 | 25,684 | 22,029 | 2,054 | 8.00% |

| 2020 | 25,776 | 22,752 | 1,443 | 5.60% |

| 2019 | 25,877 | 23,001 | 1,300 | 5.02% |

… and there’s been some solid progress here. These include Vuse in vapour, Velo nicotine pouches, and the glo heat-not-burn range.

In the first half of 2025, smokeless products accounted for 18.2% of group revenue, up from just over 16% in 2022. The regional mix is also interesting. In some markets, the transformation is much further along.

France has now passed 30% of sales from non-combustibles, while the UK, Japan, Poland, and Kazakhstan are already above 50% thanks to strong adoption of products like glo.

One of the real standout stories is Velo. In the U.S., Velo Plus has exploded, with revenue up nearly 400% year-on-year and volume share hitting 13.2% by mid-2025, compared to just 6.8% at the end of 2024. In Scandinavia and parts of Europe, Velo is also carving out strong positions, pushing BAT into the leadership spot in markets where Swedish Match once dominated.

Vuse remains another crown jewel. Despite challenges from illicit disposables, it still commands a 49.5% value share in the U.S. vapour market, making it the undisputed leader. And with premium innovations like Vuse Ultra rolling out in Canada and beyond, BAT is clearly intent on protecting that dominance.

Business Performance

In the first deep dive, we focused more on 10 years of financial data; however, it makes sense to look at the last five years, given that the Combustible business is in a managed, yet undeniable, decline.

In contrast, the New Categories portfolio is experiencing significant growth, though it remains a much smaller portion of total revenue.

Combustible revenues experienced declines of 4% in 2023 and an additional 6% in 2024. This decline is a direct result of falling smoking rates and is a headwind that the company must consistently overcome.

Conversely, the New Categories have grown at a rapid pace. Revenue from this segment was up by 42.4% in 2021 and 40.9% in 2022, and reached £3.3 billion in 2023, a 21% increase year-over-year. In 2024, New Categories revenue reached £3.4 billion, representing 13.5% of total group revenue.

This growth is mirrored by the expansion of the non-combustible consumer base, a key performance indicator for the company’s transformation. The number of non-combustible product consumers grew from 13.5 million in 2021 to 18.3 million in 2022 and further to 29.1 million in 2024.

The company has an ambitious long-term target of reaching 50 million consumers by 2030 and aims for non-combustible products to account for at least 50% of its revenue by 2035.

The table below is quite clear that while New Categories are growing rapidly, their revenue of £3.4 billion in 2024 is still a small fraction of the £20.7 billion generated by combustibles.

| Year | Total Group Revenue (£m) | Revenue from Combustibles (£m) | Revenue from New Categories (£m) | New Categories Revenue (% of Total) |

|---|---|---|---|---|

| 2024 | 25,900 | 20,700 | 3,400 | 13.13% |

| 2023 | 25,600 | 22,100 | 3,312 | 12.94% |

| 2022 | 27,655 | 23,030 | 2,894 | 10.46% |

| 2021 | 25,684 | 22,029 | 2,054 | 8.00% |

| 2020 | 25,776 | 22,752 | 1,443 | 5.60% |

| 2019 | 25,877 | 23,001 | 1,300 | 5.02% |

There is a high execution risk here for management, as for the company to achieve its long-term target of a 50% revenue mix from non-combustibles by 2035, the current growth rate must not only be sustained but likely accelerated.

This might be achieved more because of the decline in the combustible market than the growth in new products, which is something to bear in mind, but ideally, we would want revenue for this line to be above 12.5 billion.

Key Takeaways

📣Acquiring Reynolds was a crucial decision, as it gave BAT access to the highly lucrative US market. ( Which is the only market growing over the last few years)

📣 New Categories is growing fast, but the question is if it can keep up this momentum, especially as the combustible market is declining. The race is on between the inevitable decline of the core combustible business and the successful, profitable scaling of the new portfolio.

📣 A tagline change might sometimes be overlooked, but in BAT case, it is a clear sign that the focus is now on New categories. The good news is that in some regions, the uptake in these products is substantial, such as in the UK.

Financial Performance

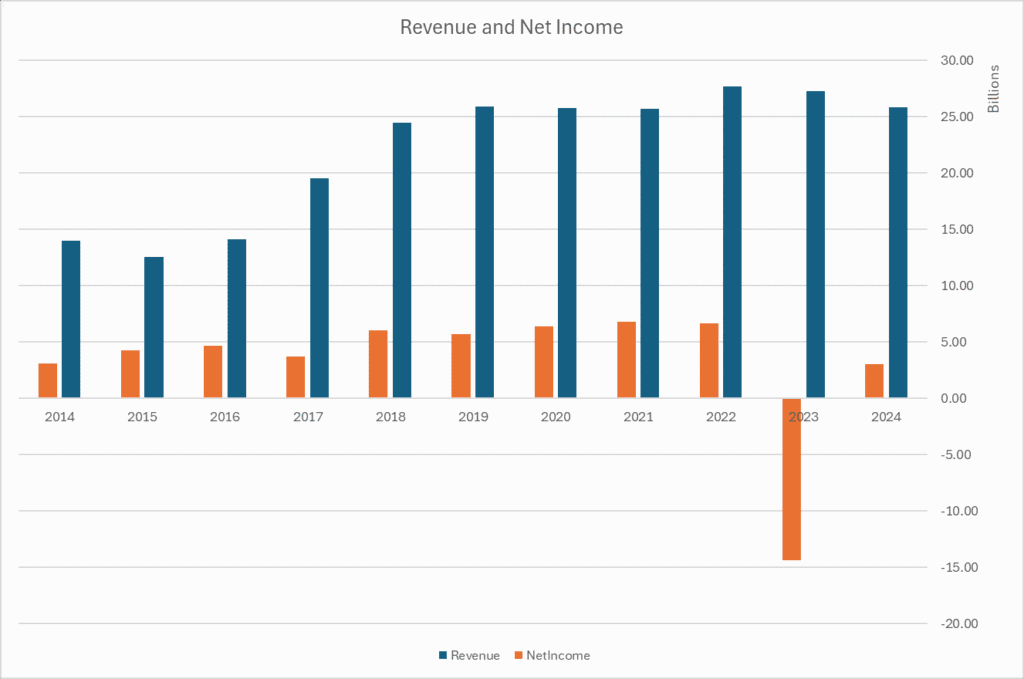

We have looked at the company’s revenue in the last section, and again referring to the table, we can see that the total revenue since 2020 has been volatile. It saw a marginal decline of 0.4% in 2020, grew by 7.7% in 2022 to £27,655 million, but then declined again to £25.9 billion in 2024.

However, one of the appeals of BAT is its geographic diversity, which is why a more accurate picture of the underlying operational performance may be found using constant currency metrics. When it comes to profitability, it’s really a story of two sets of numbers.

On the adjusted side, BAT has been able to keep things moving in the right direction. Adjusted operations were up 1.4% in 2024 to £12.4 billion, driven by ongoing cost-saving programmes.

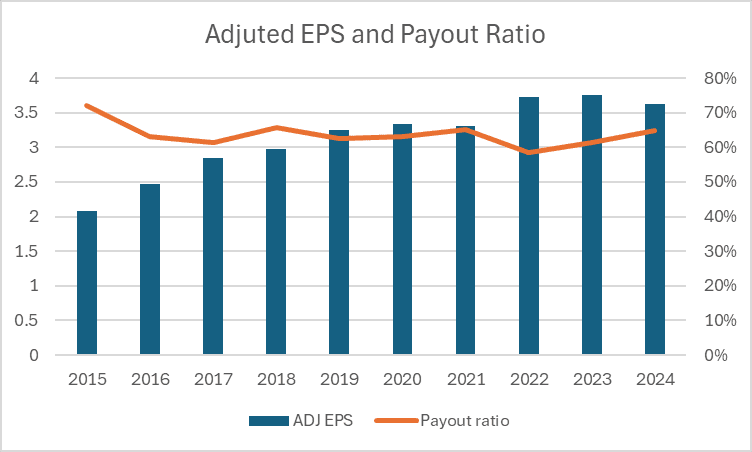

Adjusted EPS also grew by 3.6%, which gives us a fairer view of the company’s real earnings power. Strip away the noise and you can see the core business still has plenty of strength.

The problem is that the reported figures often look a lot uglier. In 2023, BAT booked a massive £14.2 billion loss, entirely down to a non-cash impairment on its U.S. assets.

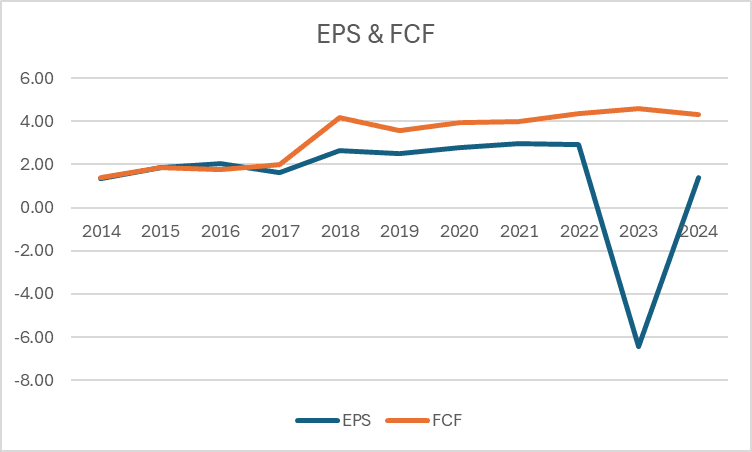

These one-offs distort the bottom line, and it’s why the 5-year EPS CAGR now sits in negative territory. So while adjusted EPS shows steady progress, the basic EPS trend tells a much more sobering story.

What’s been holding things together is BAT’s cost saving work. Project Quantum alone has delivered £1.9 billion in annualised cost savings, and Project QUEST is pushing the wider organisation to be leaner, more digital, and more agile. These programmes are vital because they’ve helped offset falling volumes in combustibles and kept cash flow strong.

And make no mistake, cash flow is still BAT’s biggest strength. The company has converted more than 100% of its operating profit into cash for five years running.

That cash engine funds everything we care about, such as the dividend, debt reduction, and reinvestment into New Categories. Management has even guided to £50 billion in free cash flow between 2025 and 2030, which is the number I’ll be watching closely.

That said, we can’t just ignore the gap between reported and adjusted results. Adjusted numbers are useful for showing the underlying trend, but when write-downs and litigation costs keep cropping up year after year, they stop looking “one-off.”

The truth is somewhere in between: BAT has a solid, cash-rich business model, but its balance sheet still carries the weight of past acquisitions and regulatory risks that will continue to flare up.

For me, it’s less about whether the dividend is safe (spoiler, we do its safe) and more about how much headroom there really is for dividend growth.

British American Tobacco Dividend

As regular readers know, dividend safety is at the heart of everything we do. Yield, valuation, and business quality are all important, but at the end of the day, none of it matters if the dividend isn’t dependable.

That’s why we built a simple framework around five questions:

- Does the company grow?

- What are its future growth prospects?

- Is the balance sheet healthy?

- Can it actually afford the dividend?

- Has management shown commitment to paying and growing it?

Each stock we cover gets a score out of 100 based on these pillars. A score above 70 gives us real confidence, while anything in the 60s is still “safe” but worth keeping a closer eye on. It’s not a guarantee, but it gives us a disciplined way to separate reliable income payers from riskier names, and it’s the exact lens we’ll now apply to BAT.

Does the company grow?

Let’s start with the income statement. The reality is that BAT hasn’t shown any meaningful growth since 2017, when the big jump came from its stake in Reynolds. Since then, both the top line and the bottom line have largely stalled, and over the past three years they’ve actually moved backwards.

On a per-share basis, the picture looks a bit better, but that’s mainly thanks to buybacks rather than true underlying expansion. Management’s continued repurchases have supported EPS and free cash flow per share, while the huge write-downs on U.S. brands distort the last two years of EPS numbers.

If you look through that noise, free cash flow per share has compounded at roughly 12% since 2014, which is impressive but again, a lot of that is down to fewer shares.

Finally, the dividend growth, while it looks better than the FCF when you look at both charts visually, the CAGR since 2014 is ~ 7%. I always like to see FCF growth outpace dividend growth. However, remember that this growth is primarily driven by the company repurchasing its shares, rather than the dollar amount of free cash flow growth.

Even so, this does highlight the power of buybacks when the stock trades below intrinsic value. Shareholders like us get the benefit of rising per-share metrics even if the total cash pool isn’t really growing.

That said, I think it’s fair to conclude that growth has slowed noticeably from when we did the original deep dive, and the heavy lifting now comes more from financial engineering than genuine business expansion.

What are the future prospects?

Looking ahead, the question is whether BAT can get back on a real growth track. Combustibles are in decline, and while pricing power and brand loyalty can soften the hit, volumes will keep trending down.

That means the heavy lifting has to come from New Categories. The good news is that the momentum here is real. In H1 2025, smokeless products made up 18.2% of group revenue, up from just over 16% in 2022.

In several markets, the shift is even more dramatic, with non-combustibles already above 30% of revenue in France and over 50% in the UK, Japan, Poland and Kazakhstan.

Vuse remains the star of the show, with a 49.5% value share of the U.S. vapour market, making it the clear leader despite rising pressure from illicit disposables. Velo is quickly turning into another growth prospect, with U.S. revenue up nearly 400% year-on-year in H1 2025 and volume share rising to 13.2%, compared with just 6.8% at the end of 2024. If that kind of growth continues, Velo could become a real challenger to Philip Morris in oral nicotine.

Management’s target of 50 million smokeless consumers by 2030 looks achievable at a ~9.5% CAGR from the current 29.1 million base. Hitting it would mean well over £5 billion in New Category sales within the next couple of years, which would start to rebalance the business.

The challenge, of course, is scale. Even with strong double-digit growth, combustibles will still account for the majority of sales for years to come. In my view, BAT’s growth prospects are capped as the drag from combustibles is too big to ignore.

Again, I anticipate modest earnings and free cash flow growth, which may be enough to keep the dividend creeping slightly higher, but not enough to satisfy the growth in dividend Growth investing.

Is the balance sheet healthy?

Next up is the balance sheet, and this is where BAT is a bit of a mixed bag. On the one hand, the company has made real progress in deleveraging since the Reynolds deal.

Net debt to EBITDA is now down to 2.4x, which is comfortably within management’s target range of 2.0–2.5x. All three major rating agencies still assign BAT an investment-grade rating, with S&P and Fitch at BBB+ and Moody’s at Baa1.

On the other hand, the absolute level of debt is still high at around £46 billion, and the quality of the balance sheet isn’t great as a huge 82% of equity is tied up in goodwill and intangibles from past acquisitions. That means the “hard asset” backing here is small, and it’s exactly why we saw that £31.5 billion impairment hit on U.S. brands in 2023.

Liquidity isn’t really an issue, cash conversion has been consistently over 100% for five years running, so the business throws off plenty of cash to service debt, fund the dividend, and invest in New Categories. But interest coverage has slipped from 7.6x in 2020 to just over 4x now, showing that rising interest costs are starting to hit a little harder.

So is the balance sheet healthy? I’d call it stable but a little to the leveraged side. BAT has the cash flow to manage its debt, but the heavy reliance on intangibles and the sheer size of borrowings mean there isn’t much room for error. From a dividend safety perspective, it’s good enough for now.

Can they afford the dividend?

Now let’s talk about whether BAT can actually afford its dividend. On the face of it, the numbers look good. In 2024 the company paid out around £5.2 billion in dividends against £9.5 billion in free cash flow, which works out to a payout ratio of about 54%.

From a cash flow perspective, BAT has been remarkably consistent. That’s what funds the dividend, debt reduction, and the £1.1 billion buyback scheduled for 2025. It also supports management’s longer-term guidance of generating £50 billion in free cash flow between 2025 and 2030, which should cover the dividend over that period.

However, I am going to repeat it, the catch is growth. Because the dividend is already taking up more than half of free cash flow, there isn’t much room to grow the dividend without stretching the balance sheet.

Unless free cash flow grows faster than expected, dividend growth is likely to stay in the 1–2% per year range we’ve seen recently.

Has management shown commitment to paying and growing it

A company’s dividend policy is the first thing we seek out when gauging management’s commitment. It is especially important when companies go through a couple of quarters of hard times.

| Dividend Policy: The Group’s policy is to pay dividends of 65% of long-term sustainable earnings, calculated with reference to adjusted diluted earnings per share. |

Management has a dividend policy of paying out 65% of adjusted eps, and historically, we can see that they have constantly stayed between 60 and 65%

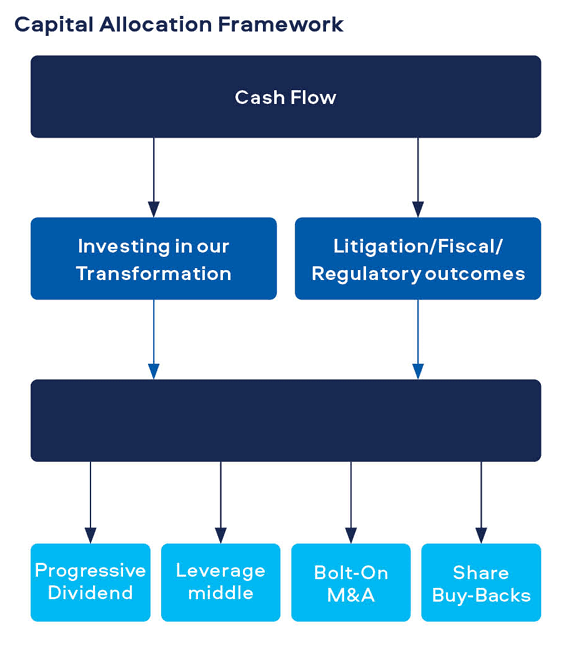

The company details its full capital allocation framework in the 2024 Annual Report. The business is still highly cash generative, with strong conversion rates above 100% for five years running, according to its investor factsheet.

That cash gets funnelled into a few key areas, such as investing in transformation like New Categories, handling regulatory and litigation costs, and ultimately rewarding shareholders.

On the investment side, around £650 million of capex is planned for 2025, targeting manufacturing upgrades, digital infrastructure, and further expansion of smokeless products.

Debt reduction remains a clear priority. Borrowings have come down steadily from £49.1 billion in 2017 to £37.0 billion in 2024, with net debt/EBITDA now at 2.4x.

Lastly, the commitment to a progressive dividend is unchanged. The 2025 interim dividend was lifted by 2%, in line with recent years, and management continues to target a long-term payout of 65% of sustainable earnings.

Alongside dividends, BAT has reintroduced share buybacks, returning £700 million in 2024 with a further £900 million planned for 2025.

Dividend safety score verdict?

In the first deep dive, we assigned a dividend safety score of 73/100 for BAT. However, we feel this is a little bit too high, given that the company is in transition and we are seeing growth slow down.

That said, management has shown real commitment to a progressive dividend, and if the New Categories can continue its impressive growth and deliver on expectations, then the dividend should continue to grow.

With all things considered, we would rate the dividend safety as 65/100, meaning we believe the dividend is safe and we do not expect to see a dividend cut in the near future. The decrease in safety is mainly due to the section around if the company is growing and its future prospects.

Valuation

There are a couple of things going for BAT, including a high dividend yield; however, that yield is trending towards the low end of its historical yield.

With a strong history of paying dividends and some positive indicators in its business performance, is this yield of just over 5% worth it, considering the slow growth in dividend per share?

I would not be too keen here, but my yield on cost is edging towards 9% so I don’t mind a 1 or 2% growth rate over the next 5 years. That said, I think it is good to review our valuation models and see if there are any changes based on our expected growth rates.

Discounted Cash Flow Model

As investors focused on both value and dividend growth, our aim is to avoid paying more than the present value of future cash flows when considering investments. This is precisely the purpose of the discounted cash flow model.

However, it’s crucial to acknowledge that while this model provides valuable insights, it’s also essential to approach its outcomes with a degree of caution because forecasting with absolute precision is not possible.

However, the model enables us to examine the growth assumptions that are factored into the current stock price. So, with this in mind, let’s begin by analysing the base case.

Initially, in the first deep dive, I assumed a FCF growth rate of 3.1% CAGR through to 2028 and 2% thereafter. Over the last 5 years, the CAGR has been ~3.3% so I am comfortable with these assumptions again. I will also stick with a 10x terminal FCF multiple. I rate this with a 60% chance of happening

On the bearish side, let’s assume there are regulations around their New category products that we haven’t factored in, and growth slows down to 1.5% through 2030 and 1% thereafter. In this case, I assume an 8-terminal FCF multiple. I rate this with a 30% chance of happening

And finally, on a more optimistic note, let’s assume a 5% free cash flow CAGR and 3% thereafter. For such a case, I assume a 13 terminal FCF multiple, and I rate this as 10% chance of happening.

If we plot this into my DCF calculation template, then the outcome is as follows:

Feel free to make a copy of this template and play with the numbers yourself.

As we are working on assumptions, I like to give myself a margin of safety of 20% for these types of companies.

If we average out the three scenarios, we get a fair value price of £44.46, which is reduced to £35.53, including my margin of safety. With the current dividend, this would give a starting yield closer to 7%.

The current share price of £41.36 makes the company overvalued today compared to my model.

For the Dividend discount model, let’s assume a 2% dividend growth rate will continue for the next 10 years.

In this case, we land on a fair value price of £30.25

My fair value conclusion

With the stock currently trading at £41.36, I see BAT as overvalued relative to both of my models. In my view, the company only becomes attractive again under £35, where the risk/reward balance is more favourable and the starting yield would be closer to 7%.

Top Risks

The Decline of the Core Business – The biggest risk here is the obvious one: the decline of the core combustible business. Cigarettes still make up the lion’s share of revenue and cash flow, but smoking rates are falling year after year thanks to tighter regulation, higher taxes, and shifting consumer habits. This isn’t a short-term blip; it’s long-term. Some regions, like the Americas and parts of Europe, are holding up better, but markets like Asia-Pacific and many emerging economies are already showing real weakness. It’s basically a ticking clock for BAT’s traditional business.

Execution Risk of the Transformation Management has put a lot of weight behind its “Smokeless World” strategy, but the question is whether the New Categories can grow fast enough, and profitably enough, to make up for what’s being lost in combustibles. These products are gaining revenue share quickly, and 2024 was the first year they tipped into profitability, which is encouraging. But they’re still capital-intensive, with a high cost base, and scaling them up requires near-flawless execution. If the growth slows or margins disappoint, it won’t be enough to offset the core decline.

Regulatory and Litigation Risks – We can’t ignore regulation and litigation. This is a risk that’s always been there in tobacco, but the size of the 2023 impairment charge, a massive £31.5 billion write-down of U.S. brands, showed just how brutal it can be. Product bans, like California’s flavour ban, which forced BAT to pull nearly half of its U.S. portfolio, are another reminder of how quickly regulation can hit the bottom line.

Final Thoughts

British American Tobacco is at a real crossroads. The company has set out its stall to build a “Smokeless World,” and the numbers show that the shift is underway. New Category revenues have more than doubled since 2021, and the consumer base keeps expanding towards that 50 million target for 2030.

In simple terms, the legacy combustible business, which is in deep decline, is funding the growth of the new portfolio. That’s the real story here.

But let’s not kid ourselves either, as the road ahead is anything but easy. Cigarettes are still shrinking, EPS has been negative on a 5-year CAGR basis, and the £31.5 billion write-down in the U.S. reminded us just how quickly regulatory and market changes can hit.

The investment case for BAT isn’t about steady predictability anymore; it’s about whether management can scale New Categories fast enough, while keeping costs tight and the balance sheet under control.

Dividend growth has slowed, and buybacks have been a significant part of growth over the last five years. I should add that I’m a shareholder myself, and BAT is a fairly large position in my portfolio.

I’m comfortable holding for now because the dividend looks safe and well-covered by cash flow. But for me, execution is key. If management can’t deliver on the £50 billion free cash flow target through 2030, or worse, if the dividend is ever cut, then that would be my trigger to sell.

Yours Truly,

Derek & European Dividend Growth Investor

Disclosure of ownership:

- European Dividend Growth Investor has no position in British American Tobacco and doesn’t intend to ever invest in Tobacco shares. #HappyWifeHappyLife

- Derek owns 201 shares of the NYSE-listed stock BTI.