Welcome back, fellow Dividend Growth Investors!

We’re well and truly into the run-up to Christmas now. Mariah Carey is back on the radio, the trees are up, and Black Friday has emptied more wallets than people care to admit.

Given the time of year, it felt like the perfect moment to dig into one of Europe’s most iconic dividend staples: Diageo Plc. And as a self-confessed Guinness drinker, it only made sense that Derek would take this one on.

Interestingly, certain drinks create emotional ties to specific places, and Guinness is arguably one of the strongest examples of that. Irish people have a genuine cultural connection to it, which, even if Derek doesn’t admit it himself, comes across in the deep dive.

When you’re done reading the deep dive, European DGI has taken a look into some consumer staples as many companies in this sector seems to be trading near their 52-week lows.

Enjoy today’s newsletter!

Yours Truly,

European Dividend Growth Investor & Derek

Service updates

| Sign-up for Malmo Dividend Talk Meetup We’re organising a Dividend Talk community meetup in Malmö: a chance to connect, talk dividends, and enjoy a relaxed weekend with like-minded investors. Registration form for the Dividend Talk community meetup in Malmö. 📍 Location: Malmö, Sweden 📅 Date: Saturday, 17 January 2026 🏠 Venue: To be confirmed |

| Newsletter Schedule 🗓️ The new winter schedule is available, and expect a deep dive to be available nearly every second week until the end of the year. Issue 47: 14-Dec-2025 Issue 48: 04-Jan-2026 – Smurfit Westrock Issue 49: 18-Jan-2026 Issue 50: 01-Feb-2026 |

Stock Deep Dive

This week, we look at one of Europe’s favourite beverage companies that has been struggling over the last three years.

Stock Updates

Is LyondellBasell’s 12.8% dividend yield sustainable

Opportunities in the consumer staples sector

More and more traditional consumer staples are making headlines for trading near their 52-week lows, and in some cases, even their 5-year lows. This is interesting, as it feels like it has been many years since this sector looked this attractive.

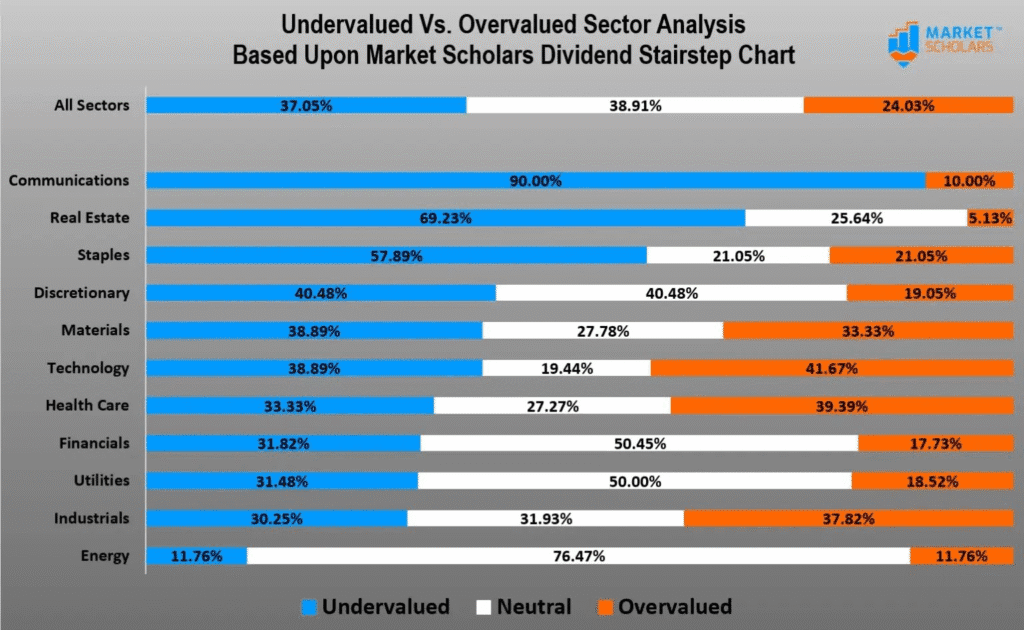

As my friend Brandon van der Zee from Market Scholars points out, the sector as a whole looks quite appealing from a dividend yield perspective when compared with its historical average.

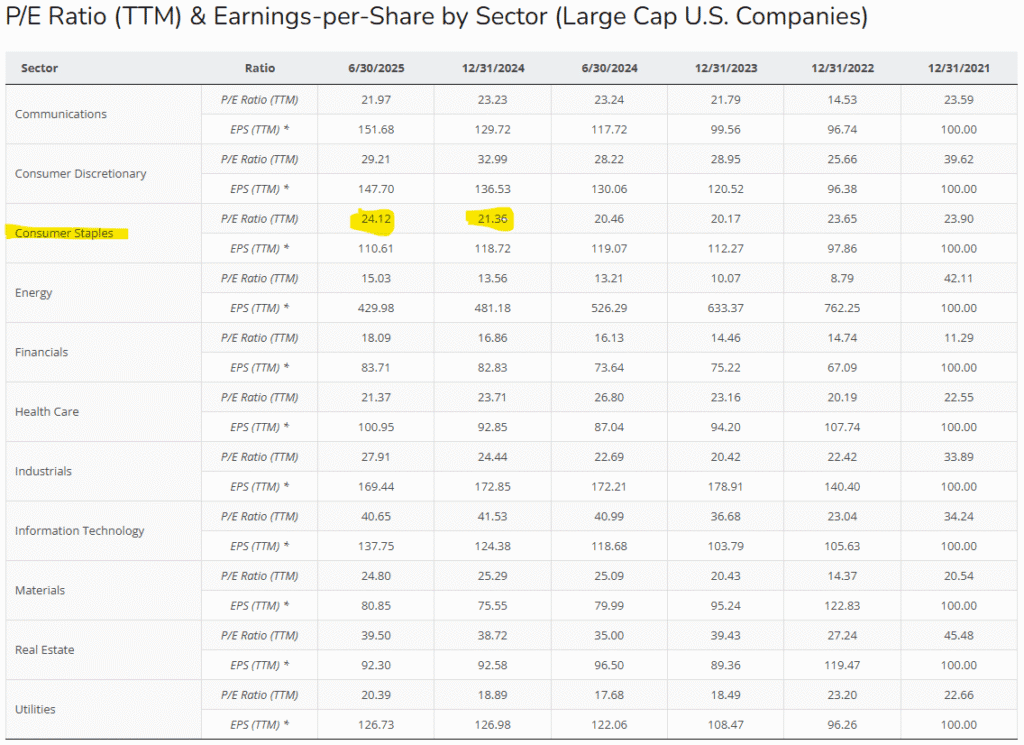

On the other hand, on a P/E multiple basis the sector looks even more expensive than what it traded for at the start of the year:

Why are we seeing such a big discrepancy?

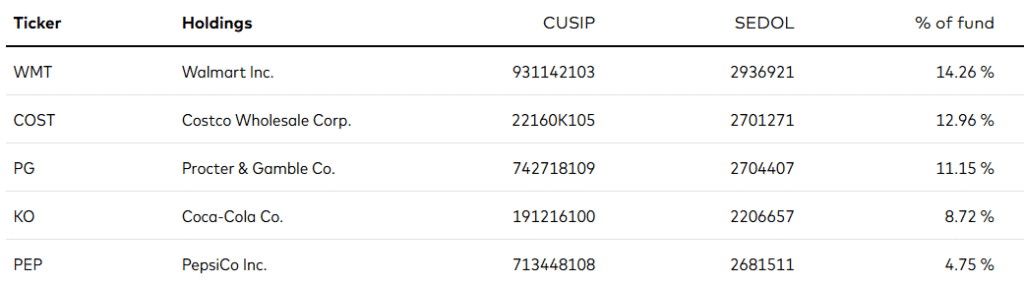

I believe the answer lies in a few Consumer Staples performing exceptionally well and having a large influence on the sector due to their massive market caps, which lift the overall averages.

For instance, Walmart has a market cap of about 880 billion (not far from a trillion), trades at a P/E ratio of 38.7, and has seen its share price rise roughly 23% year to date.

In fact, the five largest US Consumer Staples already account for more than half of the sector’s total market capitalisation.

These five combined have an average P/E ratio of 32.1, which means that the remaining hundred US consumer staples together trade at an average P/E of about 16.1.

That looks quite similar to the effect the Magnificent Seven have on the rest of the S&P 500, doesn’t it?

In other words, Brandon’s chart highlights an interesting point: the vast majority of consumer staple companies are trading close to their historical average of a 15 P/E, suggesting that this part of the market could offer plenty of opportunities right now.

So what I wanted to share with you today are a few interesting stocks currently trading within 10% of their 52-week lows, to see whether there are some that might appeal to us as long-term investors.

Before highlighting them, here’s the full list of companies that I think are worth a look and that came out of my screener for further research. Today, I’m sharing three dividend stocks with you, chosen somewhat arbitrarily and mostly based on input from our private Discord channel.

Interestingly, there aren’t many European Consumer Staples trading near their 52-week lows, which suggests that the recent revaluation has mainly affected their US counterparts over the past year.

That said, there are still a few names on this list that I’d like to explore further in some of the upcoming newsletters, as they clearly deserve dividend stock cards or perhaps even a deeper look. Feel free to reach out if there are any companies you’d like me to cover.

Here are three quick takes on companies that might catch your interest.

General Mills (GIS)

The first stock I’d like to highlight is General Mills, which is currently trading at a dividend yield higher than it did back in 2019, a time when many investors believed the company was in decline due to slowing growth and waning consumer interest in products such as Cheerios, Häagen-Dazs, and Pillsbury.

We all know what happened next. The COVID pandemic led to a surge in food- stocking, and many consumers rediscovered their taste for their type of products.

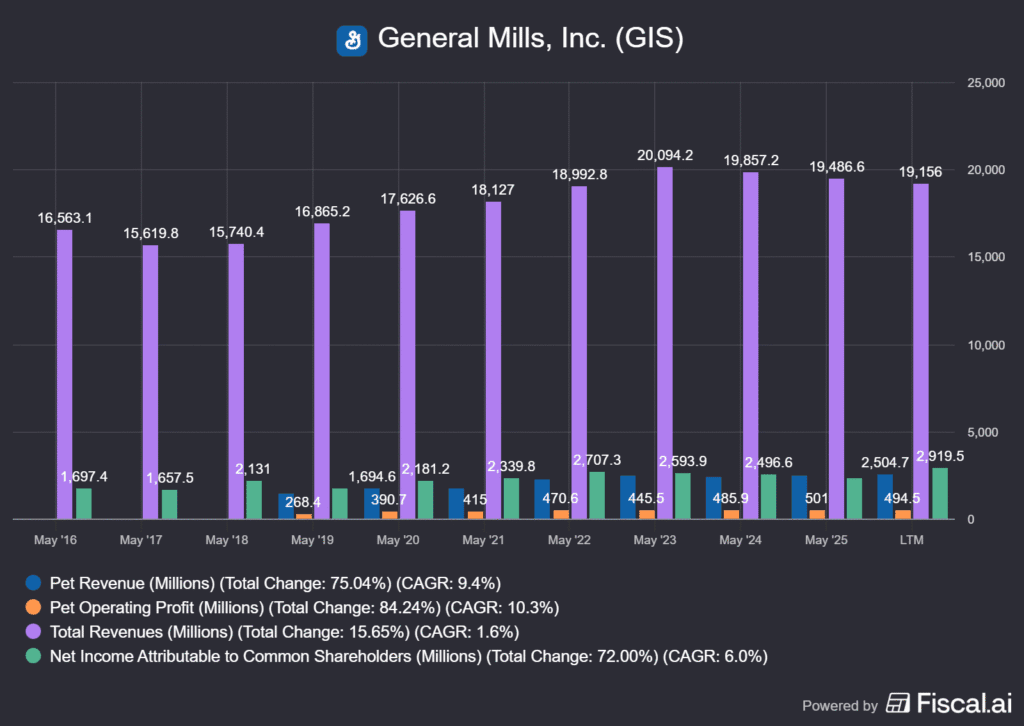

Around that time, General Mills also acquired Blue Buffalo for 8 billion USD, giving it a strong entry into the pet food market. Blue Buffalo is a premium pet food brand that the company is now expanding into the fresh pet food segment, which is expected to grow from about 3 billion today to around 10 billion over the next decade. This segment offers promising growth potential as consumers continue to pay closer attention to the quality of food they serve their pets (something I can personally relate to).

That said, I do think General Mills overpaid for the acquisition. The business generates around 500 million USD in annual operating profit, which implies a valuation north of 20 times earnings, while growth in that segment has been sluggish as of late. Still, it represents roughly 12% of total revenue and about 20% of net income, making it one of the company’s most profitable divisions.

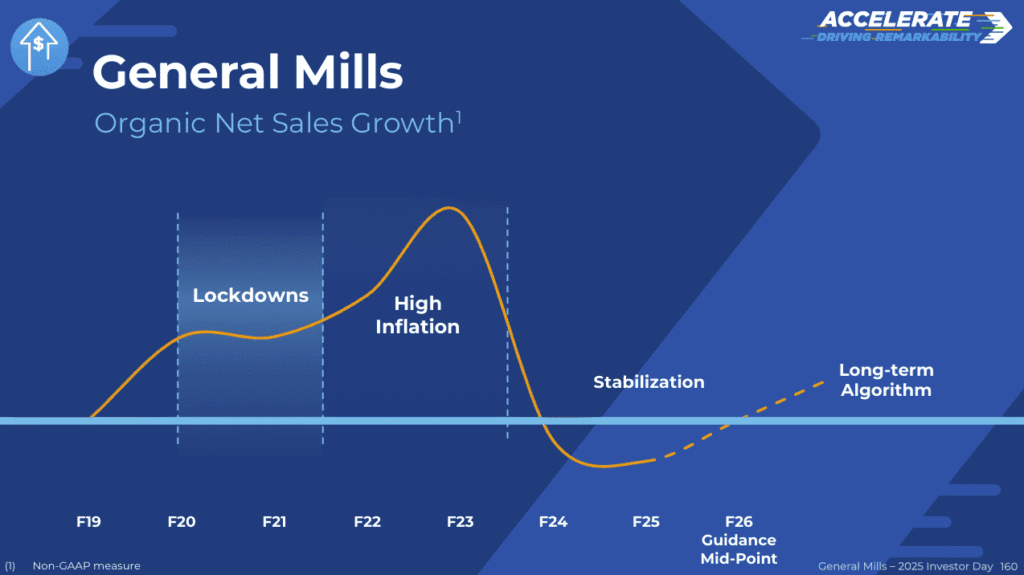

So what’s been happening with General Mills, and why is the market pricing it near its five-year lows?

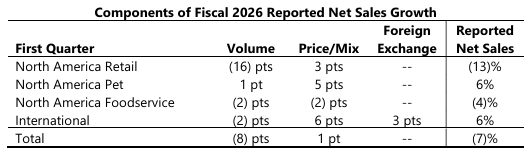

The main reason is clear: the company has been facing declining revenue for the third consecutive year, driven primarily by weakness in its North America Retail segment, which reported a steep 13% year-over-year drop in the first quarter.

This segment is by far the largest in both revenue and operating profit, which fell 24% year over year. About 8% of the revenue decline was due to the divestment of its US yoghurt business, but the broader issue has been a continued drop in volume, which also hurt profitability.

It’s no surprise, then, that the company’s shares are trading well below their 2023 levels. However, management believes that the business may now be approaching a bottom in its revenue trend.

To turn things around, the company will need to shift from relying on price increases to achieving real volume growth, as consumers have become increasingly price sensitive according to management’s own guidance. This is why the move into fresh pet food is a strategic step worth watching closely, it could serve as one of the key growth drivers for the company over the coming years.

So, the big question is: is now a good time to buy shares in General Mills?

In my view, yes.

The company has an impressive record of 96 years of uninterrupted dividend growth and a long tradition of rewarding shareholders. However, it’s officially credited with only six years of dividend growth in the Dividend Aristocrats list due to several flat periods in the past:

- 1930 to 1938

- 1940 to 1945

- 1947 to 1949

- 1950 to 1955

- 1956 to 1959

- 1961 to 1964

- 1999 to 2003

- 2018 to 2019

Is there any better demonstration than this when analysing a company’s commitment to the dividend?

Furthermore, I believe the company is attractively valued at present when looking at its multiples. However, it appears less appealing if we discount future cash flows and expected dividend increases to their present value.

We rate the dividend as safe with a score of 68 points and expect it to gradually recover over time. The company’s payout ratios are at healthy levels, providing some cushion for potential earnings pressure as it works its way back to growth.

Ultimately, the investment decision comes down to whether the 5% dividend yield offers enough compensation for that risk, given that strong dividend growth is unlikely in the near term.

Check the dividend stock card: General Mills (GIS)

The Clorox Company (CLX)

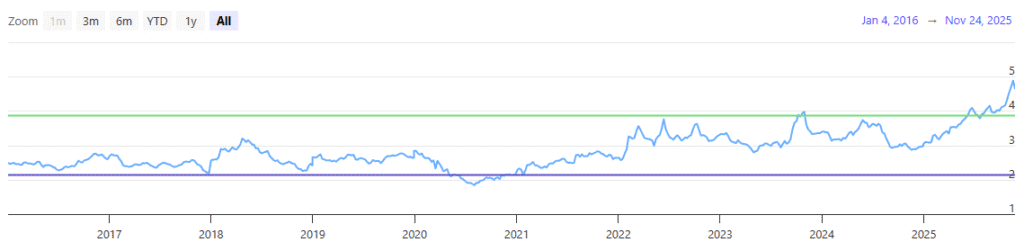

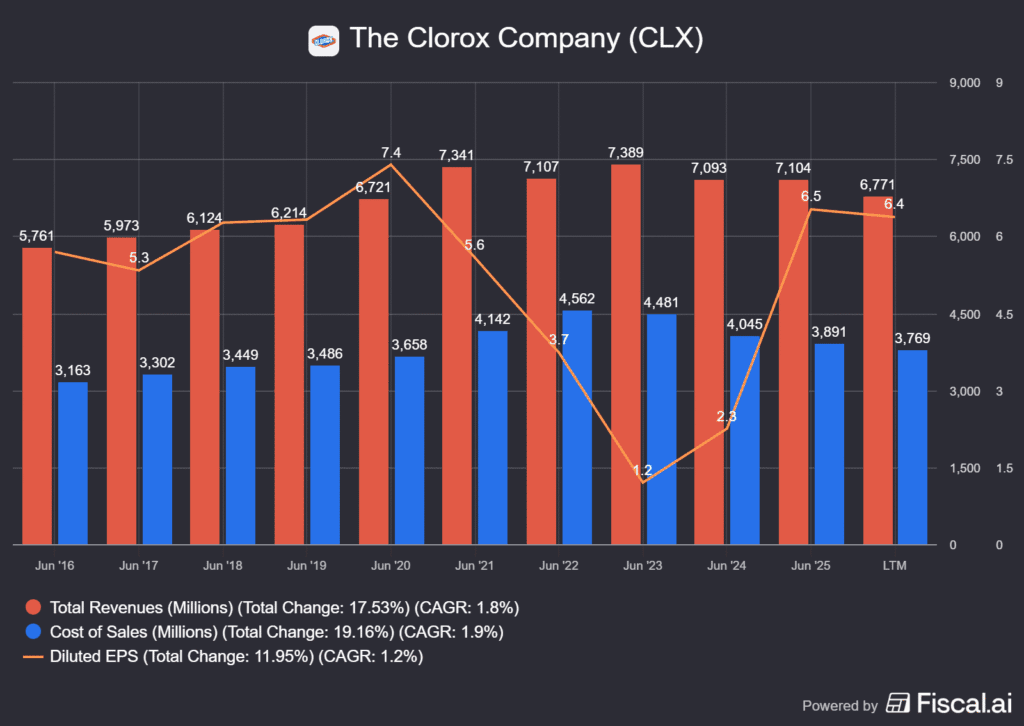

Another iconic company trading at its five-year low, or in this case, a ten-year low in share price and a ten-year high in dividend yield, is Clorox.

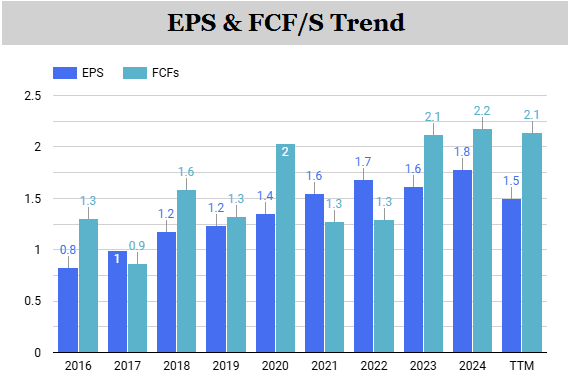

The issue becomes clear as soon as you look at the three financial statements. From both a sales and net income perspective, the company is now generating roughly the same earnings per share as it did back in 2018 and 2019, while over the past twelve months it has experienced a sharp decline in revenue.

The sharp decline over the past twelve months was largely driven by a very weak earnings report in the last quarter. That said, we need to give management a little bit of slack, because a lot originated from an ERP implementation that caused fulfilment issues, a reminder that SAP can create serious operational headaches.

Still, management can’t blame the ERP entirely. The company has been struggling with declining volume for some time, largely due to pricing. In many ways, it feels like Clorox may have pushed price increases as far as possible, resulting in more consumers to switch to private-label products.

Management argues that private-label market share remains around 17%, even as consumers have become more price sensitive. Yet both top-line and bottom-line data indicate that growing the business organically has been difficult over the past decade, discounting the Covid-driven spike in demand.

Meanwhile, the company continued raising dividends and buying back shares at elevated prices in 2019 and 2021, a strategy I don’t particularly like. That cash could have been deployed more effectively to expand the business, drive innovation, and enter new categories, supporting long-term organic growth.

But let’s have a look at the dividend safety.

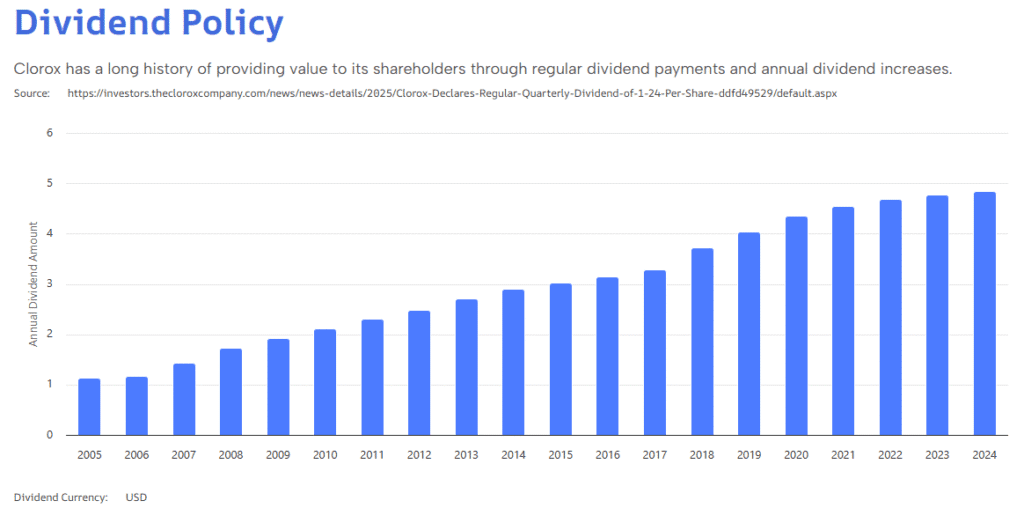

From a historical perspective, the company is approaching Dividend King status, which it will probably achieve next year.

However, we view the dividend as questionable at this stage, and therefore not safe. The company carries a high payout ratio, with a free cash flow payout of 95% and a forward payout ratio of 78%.

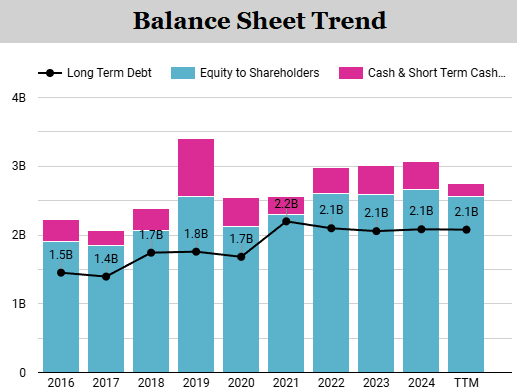

The balance sheet is also weak, largely due to past share repurchases that exceeded net income, eroding shareholders’ equity and leaving the balance sheet heavily reliant on liabilities. On the positive side, the interest coverage ratio stands at 11, meaning the company can comfortably meet its interest obligations.

The reality is that with a high payout ratio, limited balance sheet flexibility, and pressure from price-sensitive consumers, the company would be in a very vulnerable position if a severe recession were to hit.

This is unfortunate, because Clorox offers top-quality products but has not managed to deliver strong long-term value for shareholders.

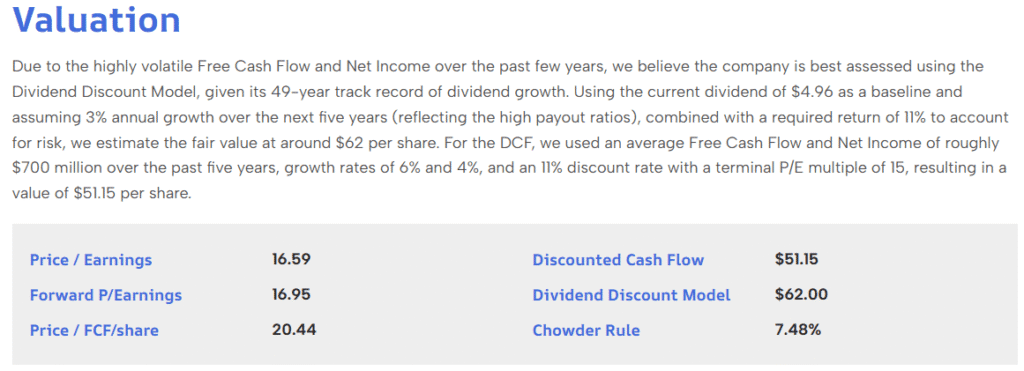

In terms of valuation, we find the stock still expensive. We assess a fair value of around $62, roughly a third of what it traded for two years ago. Based on multiples, discounted cash flow, and dividend discount models, this appears reasonable, translating to a dividend yield of approximately 8%.

While management is much more optimistic about their own strategy and future growth plans, we urge investors to treat this one with caution. Management’s track record over the last 10 years gives us no evidence at all that their predictions are worth listening to.

Check our dividend stock card: The Clorox Company (CLX)

Nomad Foods Limited (NOMD)

Nomad Foods Limited (NOMD) is the largest frozen food company in Europe and a market leader in the savoury frozen food segment. The company owns a portfolio of well-known, iconic brands, including Birds Eye, Findus, and, most familiar to me, Iglo. Interestingly, while the company is headquartered in the UK, it is listed on the New York Stock Exchange.

The company went public in 2016 through an IPO by an investment vehicle and only recently began paying a dividend. Since then, it has performed reasonably well fundamentally, nearly doubling its earnings per share and free cash flow – broadly in line with what one might expect from a slow-growing consumer staple.

Balance sheet-wise, it looks like it has a relatively decent quality because the debt/equity is about 80%.

What may not be immediately obvious is that the situation is a bit riskier than it might appear. This is reflected by Moody’s, which rates the company’s balance sheet at B1 – in the upper tier of the junk category.

Why is that?

First, the company has an interest coverage ratio of only around 2.4, which is at the low end of what you would like to see. This doesn’t leave a lot of wiggle room if interest rates were to rise further from here.

Second, the balance sheet contains very little cash but a large amount of goodwill and intangible assets. In other words, the 2.1 billion in debt essentially covers 2.1 billion in goodwill, the premium paid over the book value of acquired assets, and the 2.5 billion in shareholder equity backs 2.5 billion in intangible assets, largely representing brand value.

This means there is little tangible value to rely on, which weakens the balance sheet. If the company were to lose market share, brand values would likely be reassessed, triggering write-offs in goodwill and intangible assets, eroding shareholder equity and sending the debt-to-equity ratio sharply higher.

Third, assuming an average net income of 225 million per year, it would take roughly nine years to pay off all debt if no funds were allocated to dividends or share buybacks. That is a long timeframe and ideally, it would be lower.

Given that a healthy balance sheet is key to dividend safety, how do we rate them?

From a dividend policy perspective, the company is still relatively young, but its track record looks promising. It initiated a dividend in 2024 of 0.15 cents per share quarterly and increased it by 13.4% to 0.17 cents this year. We should hear the 2026 dividend soon.

From a growth perspective, the company appears solid. While growth stalled over the past two years, it has generally expanded both organically and through acquisitions. Its product portfolio also benefits from two key catalysts:

- a need for healthier food choices including a good dose of protein

- a weakening consumer who’s becoming more price conscious. We know from experience that people will eat more from home during recessions – if one were to happen anytime soon.

Additionally, the payout ratios appear very healthy, with a forward EPS payout of 45% and a free cash flow payout of 31%. This gives the company plenty of room to continue paying a dividend, even if growth slows over the next few years.

Taking all of this into account, while acknowledging the balance sheet risks, we still consider the dividend safe at present and have assigned it a score of 61 points. Just safe, but by a slim margin.

So if the dividend is safe, what about valuation?

To keep it short and in line with our dividend stock card, we assess the company as fairly valued at around $14.00 per share.

That said, management is very confident that the shares are undervalued and has been aggressively buying back stock this year, reducing the share count by 8.4% year over year. They plan to continue these buybacks as long as the share price remains at current levels, which in itself represents a significant return for shareholders.

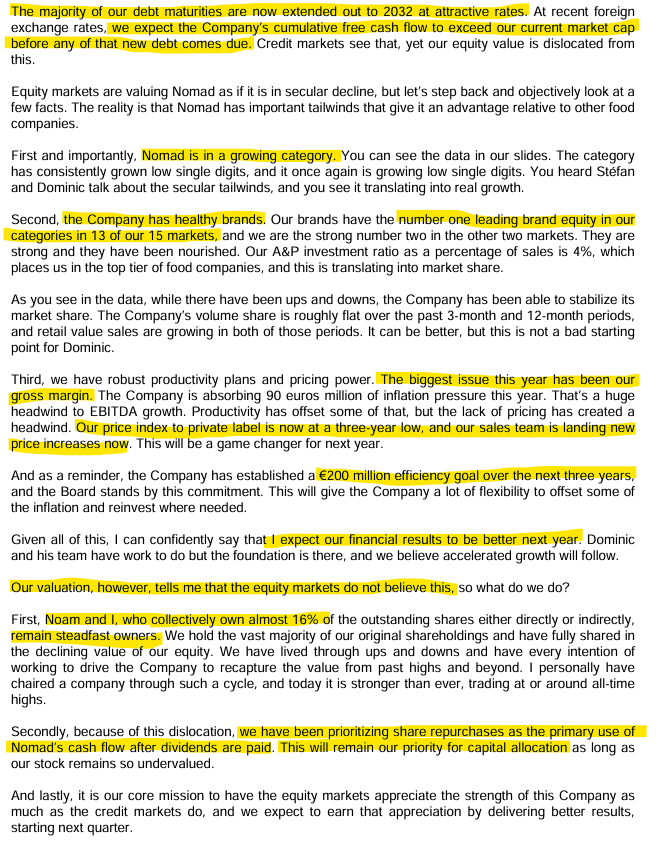

Before closing this write-up on Nomad Foods, I’d like to share management’s own commentary from their latest earnings call.

To conclude, I’ve shared my thoughts on three consumer staples trading near their 52-week lows, each with a slightly different story behind why they are at these levels. What they all have in common is exposure to a weakening consumer.

That said, we may have been a bit harsh on Clorox. The company is approaching Dividend King status, but management has yet to build consistent credibility over the past decade. Payout ratios remain high, and improvement is unlikely in the near term, aside from a potential sales recovery next quarter linked to the ERP implementation.

Clorox could regain a dividend safety upgrade if management delivers on its promises and successfully returns the business to organic growth over the next year.

Among the three, General Mills appears the strongest, while Nomad Foods stands out as an interesting small-cap focused on frozen food.

Disclosure of ownership at time of writing:

Both eDGI and Derek don’t own shares in these 3 stocks.

Our Recent Transactions

European Dividend Growth Investor

Surprise, surprise!

I recently initiated a starting position in Automatic Data Processing (ADP). I bought 4 shares at $250 each, giving me $27.2 in annual dividends. I am long-term bullish on this company and now I get the full exposure to the payrolling industry in the US. I already owned some PayChex which is rather focused on the small and medium enterprises and ADP takes in more revenue from the large corporations.

And that’s it from my side!

Derek

Over the past week, I added to three existing positions and one new position. All four purchases come from names I’ve recently analysed in depth. I also exited Altria as part of reducing my tobacco exposure.

After completing my deep dive on Aalberts I bought 50 shares of Aalberts as it looks like an attractively valued European industrial in my universe. The market continues to discount a soft industrial cycle, and I may continue to build this position.

I also added 16 shares to EOG to increase my US energy exposure.EOG has a shareholder-friendly framework that delivers a stable dividend and additional returns through special dividends and buybacks.

My Merck analysis gave me the conviction to start a small position in Merck a couple of months ago, and now I have added another 16 shares. Keytruda continues to deliver, but what gives me confidence is the depth of the pipeline behind it, and they are making some good acquisitions. Merck needs to manage its patent cliff, but its balance sheet gives them plenty of room to keep investing.

Finally, I added to my Mencsch und Machine position which again are discounted through a soft industrial cycle and a transition phase based on a Saas model. I will continue to monitor this transition next year but my position is now up to 50 shares.

Finally, I closed my Altria position via a put option. While the position wasn’t large, it became clear that I only want exposure to one tobacco company going forward. Between the two, British American Tobacco (BTI) stands out for a stronger strategy execution in next-gen products and a a broader international footprint. Altria remains a stable cash generator, but BTI is executing more convincingly and i dont need two tobacco positions.

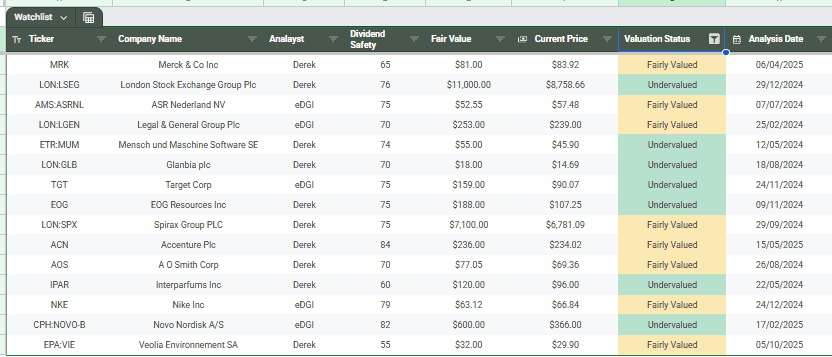

Our Watchlist

European DGI Watchlist

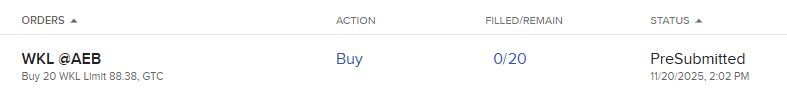

The main item on my watchlist right now is the buy order I have on Wolters Kluwer. I’m being patient here, but my gutfeel says that I’ll be rewarded for it in the upcoming few weeks.

Besides this, I’ll study a bit further the consumer staples sector, because so far I’m interested in initiating a position in General Mills (GIS) and potentially even in Nomad Foods (NOMD), but this one would be more of a value play as well.

Other than that, I may still initiate a position in TotalEnergies (TTE) if it were to come back to 50 euros again.

Last but not least, I would really like to find some time next weekend to go through my portfolio and reassess some of my holdings. For instance, there are a few holdings that I started to have doubts on due to this year’s developments:

- Greencoat UK wind Plc

- Sila Realty Trust (do i really want this one, maybe VICI is better?)

But hey, that’s it from my side. Opportunities enough right now!

Derek’s Watchlist

Not much has changed on my watchlist, but I have added Aalberts to the list. I’m still unsure if I want to add them to my portfolio, but I do lack some European Industrials, so I will assess this over the next couple of weeks before I make my next purchase.

Stock Card Updates

Over the last two weeks, we have assessed the following companies and created or updated the related dividend stock cards:

- General Mills Inc (GIS) – Dividend Talk (new)

- The Clorox Company (CLX) – Dividend Talk (new)

- Nomad Foods Limited (NOMD) (new)

- LyondellBasel Industries (LYB) (update)

| Note: Your Feedback is important to us. Please let us know if there is anything you feel we could improve on |