It’s an old piece of stock market wisdom that any dividend yield around 10% is a red flag and usually signals that a dividend cut is coming soon. So let’s take a look at LyondellBasell (LYB) and assess its dividend safety to see if the famous phrase applies: “this time is different.”

To understand the situation, we first need to look at what’s happening in the chemical industry. Right now, especially in Europe and Asia, demand for polyolefins is historically weak following the post-COVID spike that ended around the third quarter of 2022. Volumes remain low as customers continue to sell down inventories, while at the same time the market faces an oversupply due to new capacity additions, particularly in China, outpacing the recovery in demand.

This is putting LYB’s margins under heavy pressure. In response, the company plans to idle a cracker in Wesseling, Germany, for at least 40 days in the fourth quarter to reduce operating costs. After all, why keep a loss-making asset running?

But that’s not the only factor putting pressure on margins. LYB is facing a double whammy, as natural gas and ethane costs are also expected to increase. When pricing pressure combines with increasing input costs, it’s no surprise that margins are eroding fast.

So what does this mean from a financial standpoint? A decline in revenue and earnings is one thing, but is the company’s financial health also being affected?

From that angle, the picture actually doesn’t look too bad.

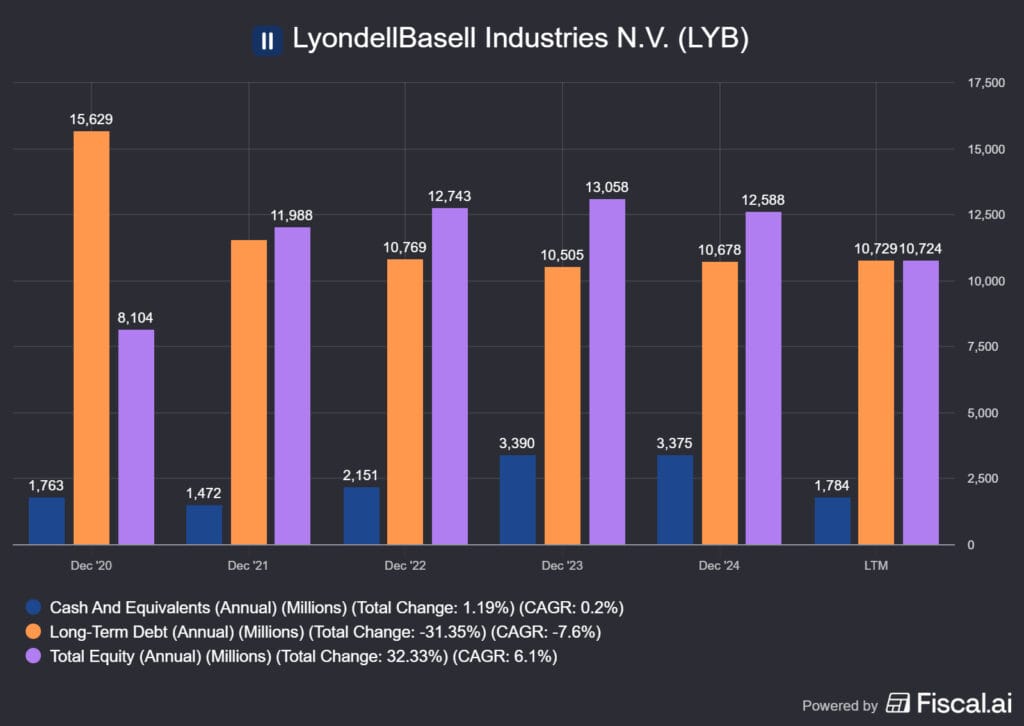

Long-term debt has remained fairly stable since 2021, averaging between 10 and 11 billion. Cash and cash equivalents increased from about 1.7 billion to 3.4 billion last year but have now come down again to around 1.8 billion.

The biggest impact over the past two years has been on shareholder equity. This comes due to losses reported on the income statement, including 2.1 billion in write-downs related to asset revaluations (1.2 billion) and goodwill (0.9 billion). These are non-cash accounting adjustments, so they don’t directly affect cash flow, but they still matter.

Why?

Because they push the debt-to-equity ratio from 80% to 100%, which could put pressure on the company’s credit rating. A downgrade would in turn lead to higher interest expenses as outstanding bonds get repriced.

So, what does management have to say about all this?

“Our Cash Improvement Plan is on track to achieve our $600 million target in 2025 and a minimum of $1.1 billion by the end of 2026, by reducing fixed costs, managing working capital and optimizing capital investment to strengthen free cash flow. We are prioritizing our investment-grade balance sheet while investing in safe and reliable operations. Our strategy is resilient and we remain confident in our ability to create long-term value for investors.”

The sentence highlighted in bold says it all, it clearly signals that the dividend will be cut to protect the credit rating when things get tight. We’ve seen this scenario before, so why would it be any different this time?

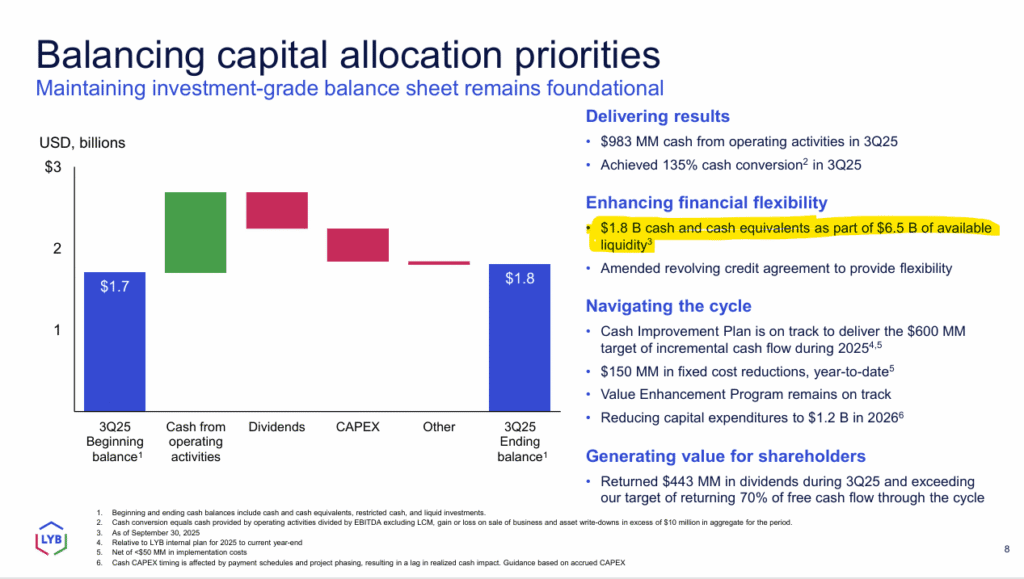

Management pointed out that they managed to maintain their cash position over the last quarter, which is quite an achievement in itself.

Let’s not forget that in 2024 the company still had 3.4 billion in cash on its balance sheet, meaning only about half of that remains today.

Credit where it’s due, though, this is exactly why management keeps cash reserves. It allows them to navigate the cyclical swings of the business. Now is the time to use that cushion to protect the interests of income-seeking investors.

What I find most interesting, however, is how the credit rating agencies view these challenges.

The company held a Baa1 rating for quite some time until mid-2020, when it was downgraded to Baa2, still a lower-medium-grade credit rating.

In the most recent update, the outlook was changed from neutral to negative due to the rapid and significant decline in earnings and the higher debt leverage (as mentioned earlier regarding the debt-to-equity ratio). Below are a few key statements from the analyst’s report:

“In particular, continuing large dividend payments without earnings recovery would accelerate our consideration for a lower rating.“

“Free cash flow after dividends will turn negative in 2025, for the first time in five years. In 2026, cash payment related to business divesture and restructuring in Europe will amount to about $400 million to $450 million, partly offsetting the benefits of cash savings in capex, working capital and fixed costs. The company’s credit metrics could weaken further, should management continue to make large dividend payments in the absence of earnings rebound.”

“Its credit profile is also supported by management commitment to maintaining net leverage below 2.5x (excluding Moody’s adjustments). We expect the company will demonstrate discipline in capital allocation given the extended market weakness.”

In other words, the credit rating agency is clearly signalling that LYB should cut its dividend if it wants to maintain its rating. And based on experience, the weight of such a message should not be underestimated, management will take this seriously.

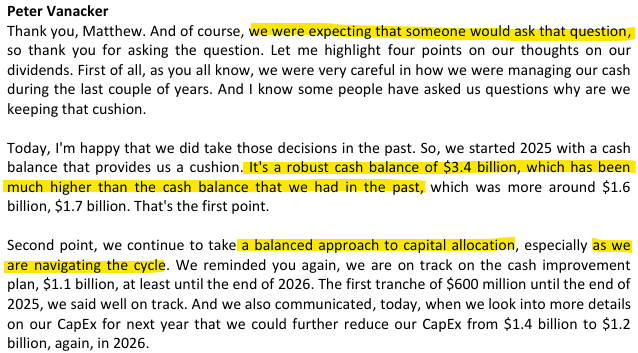

So what did they have to say about the dividend in the Q3 earnings call? After all, during the Q2 call they were still very firm about its importance.

First of all, credit to the analyst for asking the right question and to management for giving such an honest answer. That response, which was far less confident about the dividend than before, combined with the clear warning from the credit rating agency, makes one thing obvious: the current dividend is hanging by a thread. Its fate depends on a near term recovery in earnings over the next few months rather than over the next year.

And since management already guided for weaker earnings, even after today’s dividend announcement (unchanged from the previous quarter), my view is that the dividend will have to be cut in the first quarter of 2026. That would ease pressure on the balance sheet and help avoid a possible credit rating downgrade.

So to answer the question at the start of this writing: no, this time will most likely not be different.

It’s a pity, because management seems good, the balance sheet is relatively strong, but the sharp earnings drop caused by the downturn in the chemical industry is simply too much for LYB to absorb if it continues for another few quarters. And it is not just LYB. Many peers such as BASF and Dow Chemical are under similar pressure. This industry slowdown is not taking any prisoners.

According to our model, the dividend now rates as questionable with 44 points, at the bottom of that category. It still earns full points for dividend history and policy, but it scores zero on payout ratios and on revenue and earnings performance. It retains some points for the balance sheet and long term growth outlook, but there is no way around downgrading the safety rating from safe (barely at 60 points) to questionable (44 points).

But here we have it, a clear example of a cyclical company. As a dividend growth investor, I prefer to keep my exposure to such businesses to a minimum, though I do appreciate the income they provide throughout the cycle.

So far, BHP and Rio Tinto have treated me well, but I know their dividends will fluctuate. That is why I plan to build in some margin within my dividend income once I reach the dividend-to-expense crossover point, just in case I retire at the start of a major downturn that hits the income from my cyclical holdings, even if that exposure remains small.

As for my own position, it is a small holding in my portfolio, and I was well aware of the risks when I bought it. For now, I will hold on since the valuation still looks attractive relative to the share price, but I may sell as soon as the market closes that gap unless the dividend remains attractive post-dividend cut.

Disclosure: I own shares in LYB.