Investing in UK dividend stocks can be a reliable way to generate passive income, but not all dividend stocks are created equal. The key to a sustainable dividend portfolio lies in its dividend safety profile. In my opinion, a safe dividend is backed by consistent earnings and cash flow growth, a responsible payout ratio, a solid balance sheet, and clear management commitment to a growing dividend.

One of the unique advantages of British dividend stocks is the favourable 0% dividend withholding tax. This makes them particularly attractive for international investors, though local taxation still applies based on individual country regulations.

For those looking to build a dependable income stream, here are five UK dividend stocks that have a track record of providing stability and long-term growth potential.

British American Tobacco (BATS.L)

British American Tobacco is one of the world’s largest tobacco companies, with a portfolio that includes well-known cigarette brands (Dunhill, Lucky Strike) as well as a growing presence in next-generation nicotine products (Vuse, Velo, Glo). The company generates strong cash flows, benefiting from high margins and a globally diversified customer base.

- Dividend Growth History: 23 Years

- Payout Ratio: 66%

- Dividend Yield: 7.057%

- 5-Year Dividend CAGR: 2.32%

Interested in reading our deep dive about British American Tobacco? It’s part of our free-samples, get access here.

Halma Plc (HLMA.L)

Halma is a global group of safety and environmental technology companies, operating in sectors such as health, infrastructure, and industrial safety. The company has a strong track record of steady revenue and profit growth, driven by its strategy of acquiring niche businesses with resilient demand.

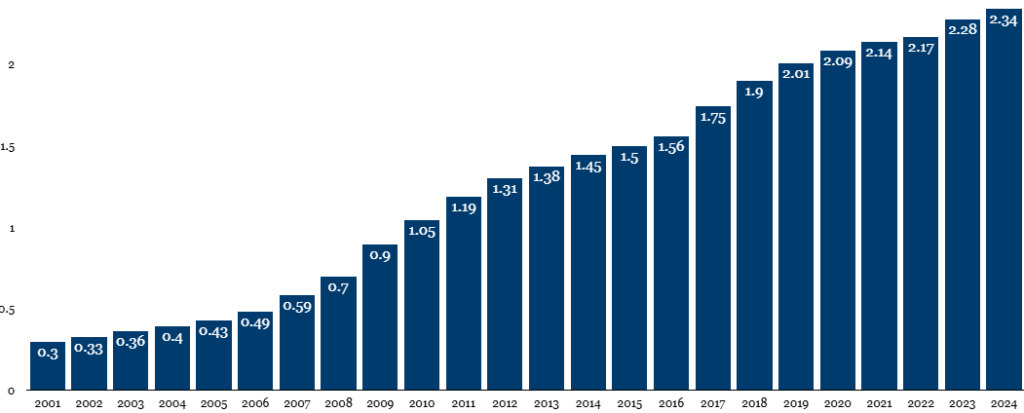

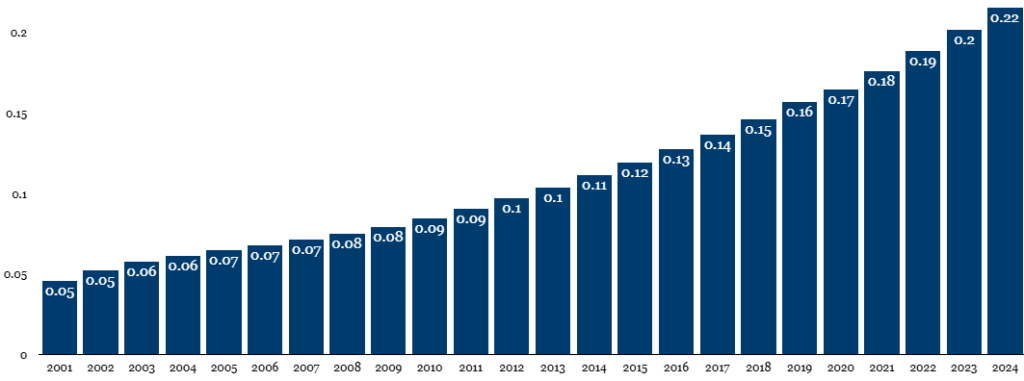

- Dividend Growth History: 43 Years

- Payout Ratio: 29%

- Dividend Yield: 0.78%

- 5-Year Dividend CAGR: 7.16%

Greggs (GRG.L)

Greggs is a leading UK bakery chain, offering a range of affordable food products, from pastries to sandwiches and coffee. The company has grown its store network significantly and continues to expand into new markets, while maintaining strong brand loyalty among UK consumers.

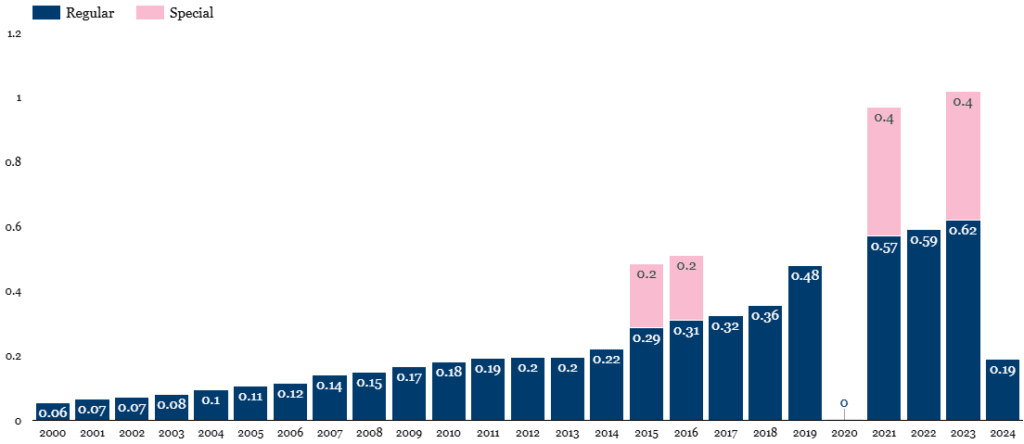

- Dividend Growth History: 4 Years

- Payout Ratio: 48%

- Dividend Yield: 3.07%

- 5-Year Dividend CAGR: 13%

Observant dividend growth investors will notice that the company did not pay a dividend in fiscal year 2020 due to the Covid-19 lockdowns. Given the nature of its business, it was directly impacted and found itself in the middle of the so-called blast zone.

As a result, management took a cautious approach and suspended the dividend until further notice. Once there was more clarity on the severity of Covid-19, the company decided to issue special dividends to compensate shareholders for the missed payments in 2020. In light of these circumstances, we are giving management a one-time pass.

🔒 Premium members can read our dividend stock card here.

The ultimate UK Dividend Stock? – Spirax Group (SPX.L)

Spirax-Sarco Engineering is a leader in steam and thermal energy solutions, serving industries ranging from pharmaceuticals to food and beverage. Its business model benefits from high-margin products and services that are essential for efficient industrial processes.

Looking at its dividend growth chart, this may well be the ultimate UK dividend stock available to investors. It is also one of the pure-play European Dividend Aristocrats.

- Dividend Growth History: 30 Years

- Payout Ratio: 61%

- Dividend Yield: 2.04%

- 5-Year Dividend CAGR: 7.75%

🔒 Premium members can read our Deep Dive about the company here.

Shell Plc (SHEL.L)

Shell is a global energy giant, playing a major role in oil, natural gas, and renewable energy solutions. The company has focused on capital discipline and shareholder returns while transitioning toward a lower-carbon energy mix.

In our opinion, this is one of the best share cannibals in the world right now, repurchasing around 6% to 8% of its shares annually at current oil and gas prices. Additionally, it has a progressive dividend policy with a target to grow the dividend by 4% annually, effectively reducing the total dividend payments each year in terms of absolute value.

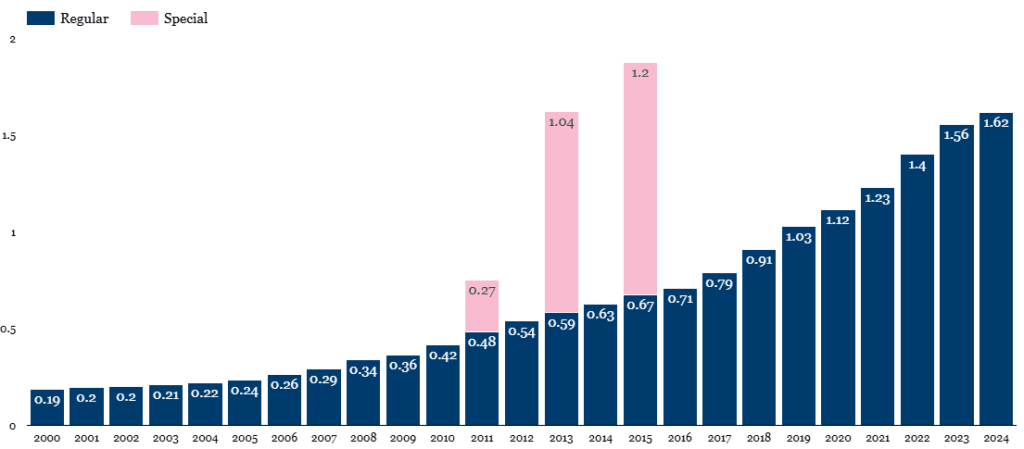

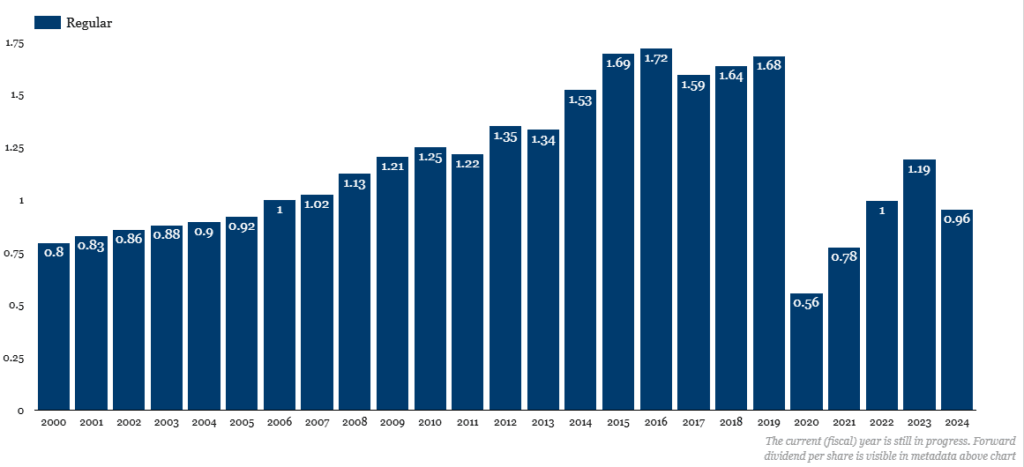

- Dividend Growth History: 4 Years

- Payout Ratio: 26%

- Dividend Yield: 4.33%

- 5-Year Dividend CAGR: -2.3% (still accounting for the dividend cut in 2020)

Here, too, observant investors will notice the dividend cut in 2020. At that time, the dividend was no longer sustainable after the severe oil glut of 2016. The company had not yet fully recovered from that, and the COVID-19 pandemic dealt the final blow to a dividend history of nearly 70 years. In our opinion, it was the right decision at the time, and the company is now in a position it hasn’t been in for decades.

Note: The dividends between 2010 and 2019 appear to fluctuate, but this is due to the USD/EUR exchange rate, as the company pays dividends in USD and the chart shows them in EUR. Over that period, the USD dividends have grown consistently until the dividend cut in March 2020. Furthermore, the 4th dividend of the 2024 fiscal calendar has not been announced yet at this time of writing. The 2025 forward dividend is 1.43 USD per share.

🔒 Premium members can read Shell’s dividend stock card here.

Summing it up

Understanding which UK dividend stocks offer the best long-term potential requires detailed analysis. However, we hope this list of the top 5 UK dividend stocks provides a good starting point for further research. According to our analysis, these companies offer safe dividends, supported by reasonable growth opportunities in the markets they operate in, management’s commitment to increasing dividends, strong financials, and conservative payout ratios.

Of course, each company carries risks and unforeseen events can put the dividends at risk. That’s why we always recommend to do your own analysis because you can’t borrow conviction in times you will need it the most.

Get Exclusive Insights on these UK Dividend Stocks

If you want to gain deeper insights into the dividend safety and valuation of these UK dividend stocks, consider becoming a Premium subscriber. Our research covers dividend safety ratings, fair value assessments, and a library of over 100 dividend stock cards to help you make informed investment decisions. [Join Today.]